Published on: May 4, 2023 Updated on: May 5, 2023

How Investors Use AI To Analyze CEOs And Their Companies

Author: Alex Tyndall

We’ve become dependent on electronic services and devices to manage our finances, businesses, and general day-to-day life. But that leaves a lot of room for confusion and error, especially for the less tech-savvy of us. This makes it easier than ever before for big corporations to hide behind smoke screens and not always be entirely honest with their customers.

Fortunately, there are certain tools that are here to help. In an age of open-source artificial intelligence (AI), it’s never been easier for regular people to stay up-to-date and informed on the issues that matter most to them. And they’re doing so in quite ingenuitive ways.

So let’s dive in and take a look at how many investors are using AI to keep an eye on CEOs, and are making the best financial decisions as a result.

How can AI help investors?

The capabilities of AI systems seem endless in the 21st century, but people are always finding new ways to test their abilities. Whilst it can be borderline impossible for people to manually keep on top of the ever-changing nature of finances, stocks, and the internals of company performances, AI can automate the process and provide essential facts and figures to help with decision-making.

Here are a couple of ways AI can be utilized by both individuals and larger groups to keep tabs on what’s going on.

Natural language processing and speech analysis

Press conferences are commonplace in the business world, and every CEO will have to make one statement or another at some point in their career. This could be for a number of positive or negative reasons.

But the language of businesses, particularly within the financial market, can be tricky to navigate. Specific use of jargon can twist a story – useful for companies wishing to keep hold of their customers and investors without worrying them, but unfortunate for people who have a lot of stake in a business and don’t want to take unnecessary risks.

Complex machine learning algorithms that make use of natural language processing (NLP) software can analyze the language patterns, tone, and intonation of C-suite executives to detect:

- Truthfulness

- Confusion

- Uncertainty

- Anger

- Worry

This can give investors and portfolio managers the upper hand when it comes to making important decisions, as they can more accurately tell if they are being lied to or manipulated in some way.

A popular use-case example comes from a Reuters report from 2021. The article explained how Evan Schnidman, Co-Founder and CEO of the NLP company Prattle Analytics, analyzed the language patterns of IT-industry executives. Their claims that a shortage of semiconductor chips would not impact the overall supply chain were proven to be untrue. A supply squeeze from a lack of these chips in the following months led to a fall in auto and industrial share prices.

It’s all very well and good talking about how NLP can be used, but how does it all work? Understanding the process of how it takes effect is the best way to learn how to implement your own version in a way that will benefit you most.

- Firstly, natural language processing algorithms need to be trained on people’s speech patterns and coded to identify certain key phrases or indicators which build the foundation for sentiment analysis.

- Sentences can be recorded into a transcript, which makes it easier to analyze and identify certain words.

- Data scientists and predetermined feature extractors can add tags and labels to parts of the dataset. Machine learning (ML) algorithms can then use these as a springboard and continue the labeling process with new data.

- Intonation, pronunciation, emphasis, tone, volume, and clarity of voice can also be analyzed. This is used in conjunction with the words spoken at the time to build patterns that help machines recognize emotions.

NLP is best utilized in situations where information is being provided without the use of a script, such as in earnings calls which happen between company directors/CFOs and stakeholders. This makes it easier for software to pick up the real-time errors that come from the overlap between speech and emotions. Hedging, pauses, or the use of certain key phrases can alert the algorithm that something is amiss.

And voila. Investors can now use AI to detect subtle changes or inconsistencies in someone’s speech which can help them make smarter personal decisions faster.

ESG investing

Environmental, social, and governance (ESG) are interesting in the sense that the data provided from this information can be used equally by both companies and their investors.

In the 21st century, a large emphasis has been placed on the value of businesses that conduct themselves ethically and sustainably. Companies that lie or fail to reach their targets are scrutinized harshly and can lose out on valuable customers who would prefer to invest in more ESG-considerate enterprises.

Once again, NLP can play a vital role here. The values of the company should be championed and adopted by everyone within it, but none more so than the C-suite executives who call the shots. If AI sentiment analysis detects that these leaders feel negatively about the ESG efforts they are talking about, then it’s likely that corners are being cut.

Things to watch out for include:

- Emissions, pollution, and waste

- Treatment of employees (employee engagement and satisfaction levels)

- Donations to charities or ESG-considerate entrepreneurs

- Commitment to DEIB (diversity, equality, inclusion, and belonging) practices

Both companies and investors can also use AI tools to look at what other businesses are doing in terms of ESG practices, current and upcoming important topics, and an even wider review of sentiment analysis from customers or the general public on social media.

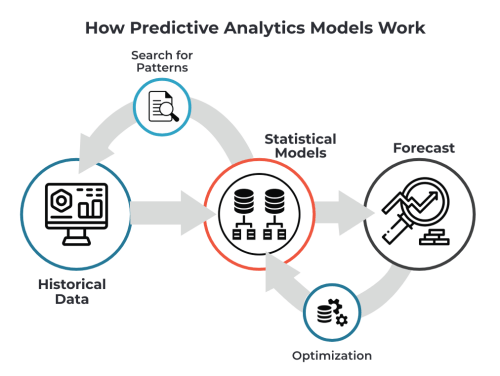

Predictive AI models

Investors, particularly those involved in stocks, shares, or hedge funds, need to be able to withdraw their money quickly if things are taking a turn for the worse. Predictive AI technology can help track potential changes by evaluating the market as a whole.

By drawing from hundreds of thousands of data points, you can be sure that you are making the most informed decisions possible.

Moreover, you can then have two AI systems working simultaneously.

- One identifies potential risks.

- The other acts on those risks by automatically moving your stocks from one place to another.

This constantly keeps you ahead of the game, as AI investment handling is significantly faster than manual handling. It’s just not practical to always be watching the markets. A little mechanical help certainly isn’t cheating.

Portfolio management

Investment advice providers and portfolio managers can use AI to cater to the individual needs of each client and personalize a strategy for every different financial situation.

Meddling or experimenting with new financial strategies can be a huge anxiety for many people. It’s why quantitative (quant) funds are so popular, currently making up over 35% of market capitalization. People trust hard data more than they do speculative human management.

A combination of both strategies – facts and figures combined with a friendly, human face – leads to a significantly improved customer experience. Money isn’t left to the whim of algorithms somewhere in the digital aether. But, likewise, it won’t fall victim to a faulty decision made by a human investment manager.

Final thoughts

Large companies like Amazon or Microsoft aren’t the only ones who have the ability to use AI to their advantage. As we’ve seen with the rapid development of software like ChatGPT, the industry is only going to continue expanding from here. As long as you have a connection to the internet, you can figure out how to use AI.

The hype is there for a reason. The balance of power continues to shift every single day, and, quite frankly, it’s fascinating to watch. Everyone’s still trying to get to grips with how programs work, which method works best, and what the next big breakthrough will be.

But, for now, if you’re worried about the future of your finances, or you fear as though company directors may be trying to pull the wool over your eyes, try investing in AI and see how it can lend a helping hand.

No one wants a repeat of what happened recently with Silicon Valley Bank. Get the insight you need to make the best financial decisions for yourself, and never be fooled again.

To keep updated on all the relevant news, stories, and updates from the world of AI technology, stay in touch with Top Apps.

Alex Tyndall

With a passion for exploring the latest apps and software, she brings a wealth of knowledge to her role as a professional writer at TopApps.ai.

Recent Articles

Microsoft servers are down. Your business grinds to a halt. Panic sets in. Stop. Breathe. You’ve got this. This guide gives you 7...

Read More

As a business leader, you’re always searching for ways to stay ahead of the competition. What about AI in marketing and sales? In...

Read More

Struggling to keep up with the competition in 2025? You’re not alone. Small and medium enterprises (SMEs) are facing a rapidly evolving business...

Read More