Published on: May 15, 2023 Updated on: February 1, 2024

How AI Financial Assistants Can Help Grow Your Investments

Author: Christina Muir

Investing can be challenging and complicated for anyone, no matter their experience level in the field. It requires a deep understanding of market trends, budgeting, and portfolio optimization, leaving little to no time for other endeavors.

However, the rise of artificial intelligence (AI) technology has opened up new possibilities for those looking to grow their investments. AI-powered virtual financial assistants (VFAa) can help you make better decisions, manage risk, and give you the best chance for maximum growth.

If this sounds good, then keep reading because we will explore how virtual financial assistants can be used to take your investments out of human hands and into the ones of AI.

As well as how beneficial these virtual assistant services can be in theory, we will also mention case studies to demonstrate how they can be applied to real-life scenarios.

Introduction to AI virtual financial assistants

The finance world is ever-evolving, and technology has played a significant role in transforming the industry. The latest addition is AI virtual financial assistants, which are powered by advanced algorithms that can:

- Sort through vast amounts of data in real time.

- Analyze market trends

- Predict outcomes

- Make suggestions to investors on what they should do next to maximize their profits

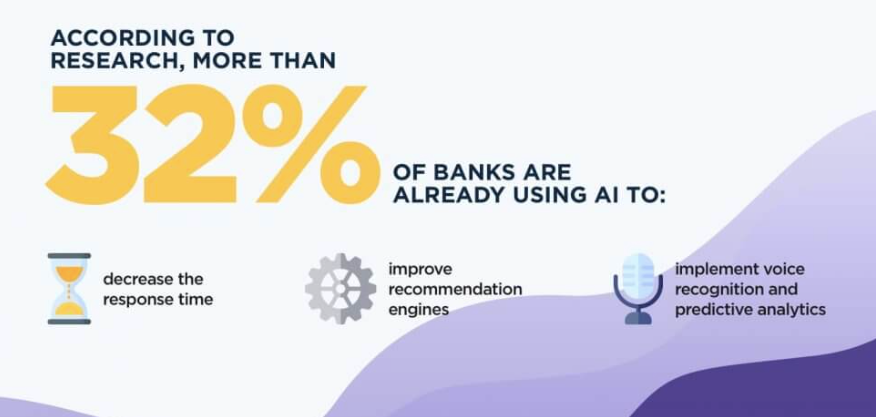

All of this valuable insight was not available beforehand, which has made these financial services skyrocket in popularity. In fact, a report published by the International Monetary Fund (IMF) stated that financial technology (fintech) companies are quickly increasing the use of AI and machine learning (ML) systems.

However, as well as being heavily adopted into financial institutions, AI virtual financial assistants have made the world of investing accessible to anyone and everyone who wishes to explore it.

Using a virtual personal finance assistant to manage your investments must be done carefully with a lot of thought and human advice, because it’s not a totally fool-proof approach. Issues such as data privacy, algorithm bias, and ongoing monitoring must be considered in order for the tool to be used in an ethical, accurate manner as intended.

5 Benefits of using AI virtual financial assistants for investment growth

Using AI, including ChatGPT, can be both a personal as well as practical experience, which makes investment growth a lot less intimidating for those starting from the ground up. Here are 5 ways in which AI VFAs can upgrade your financial wellness to a whole new level with the use of accurate data, NLP, and ML.

1. Access to real-time data and insights

These assistants are designed to analyze vast amounts of financial data from multiple sources, including:

- Financial markets

- Social media feeds

- News articles

Financial sector news feeds provide minute-by-minute updates on the latest economic indicators and market trends, which is the perfect source for artificial intelligence assistants to look to. Market data providers also offer opportunities for analysis as they show real-time data on bond yields, stock prices, and exchange rates.

By having access to data such as this, users can have immediate alerts to a sudden drop in stock value or any buying or selling that is taking place. If there is a sudden increase in demand for particular goods, then the investor on the other side of the AI assistant will be among the first to know.

2. Personalized investment advice

Unlike human financial advisors, who are limited to the number of clients they can serve, a personal AI assistant can handle millions of investors at once. This doesn’t stop them from providing information that is personalized for each person, though. AI assistants can take into account each person’s unique financial situation and where they want to be in the future.

Another advantage of AI virtual financial assistants is that they learn and adapt over time. Therefore, when a user’s personal finances change, the assistant will adjust its recommendations accordingly.

However, not everyone feels confident about putting their finances in the hands of AI and sharing information about their bank accounts and spending habits, and understandably so, as they still have their limitations.

3. Enhanced portfolio management

AI VFAs can enhance portfolio management and help grow investments with their plethora of analyzing capabilities. All of the valuable data they provide is important for diversifying investment portfolios and minimizing risk. It also identifies companies and sectors with growth potential.

By taking into account the user’s risk tolerance, AI assistants can continuously monitor the market in real time and make adjustments to the portfolio in order to take advantage of opportunities and minimize losses. Additionally, they can optimize the user’s tax position by identifying tax-efficient investment strategies and minimizing tax liabilities.

This can be used as personalized guidance for personal finance and investments, or it can be scaled up for big business.

4. Risk management and mitigation

An AI financial advisor always has an eye out for risks and will flag them even before they happen due to pattern recognition. This is done with the help of advanced algorithms and machine learning. These financial insights are perfect for striking a balance between dynamic management strategies and risk mitigation. This allows for the portfolio to always be one step ahead of trends whilst avoiding losses.

Whilst it is important for an investment portfolio to be in tune with market fluctuations, it is equally vital that they remain in line with the user’s goals. These AI tools also look out for their investors by taking fraud detection very seriously. Any customer behavior or activity is analyzed and then sent as an alert to the investor if the actions seem fraudulent.

5. Improved decision-making

There is not a lot of time for hesitation in the finance industry. But, with the help of AI, decisions can be made with confidence to ensure that an opportunity is never missed again. Virtual assistants are very effective in helping investors make informed data that optimizes their portfolio as well as make the correct choices to meet their individual goals.

Use cases of AI virtual financial assistants

To help visualize how these AI financial management service providers appear in day-to-day life, here are some of the most common ways in which they are used.

Customer onboarding

Growing your investments have never been easier with this new proactive approach to customer onboarding to get started with accounts. Your identity, supporting documents, and personalized settings can all be accepted instantly. This cuts out a lot of waiting times and not knowing whether you provided the correct information or not.

To do this, these AI tools use advanced natural language processing (NLP) as well as machine learning algorithms to make the process as quick as possible. This makes banking and investment handling much less painful and saves a lot of time for everyone.

Faster trading

With advanced data analytics, AI assistants are empowering traders to make quick and informed decisions. To achieve this, trading firms are building end-to-end trading infrastructures that combine enterprise AI with high-speed networking. This ensures that trading can be done quickly and at the highest bandwidths.

Personalized digital banking

You may be surprised, but artificial intelligence assistants can make for a very efficient customer experience with the added use of conversational AI chatbots for extra administrative support. Users can easily sign into the mobile app and check their bank accounts, plan payments, and review their account activity with ease.

AI can tap into the information gathered from other applications to learn as much as possible about the person on the other end of the screen. This allows them to give personalized financial support, with the Royal Bank of Canada leading the trend.

Examples of AI virtual financial assistants for investment growth

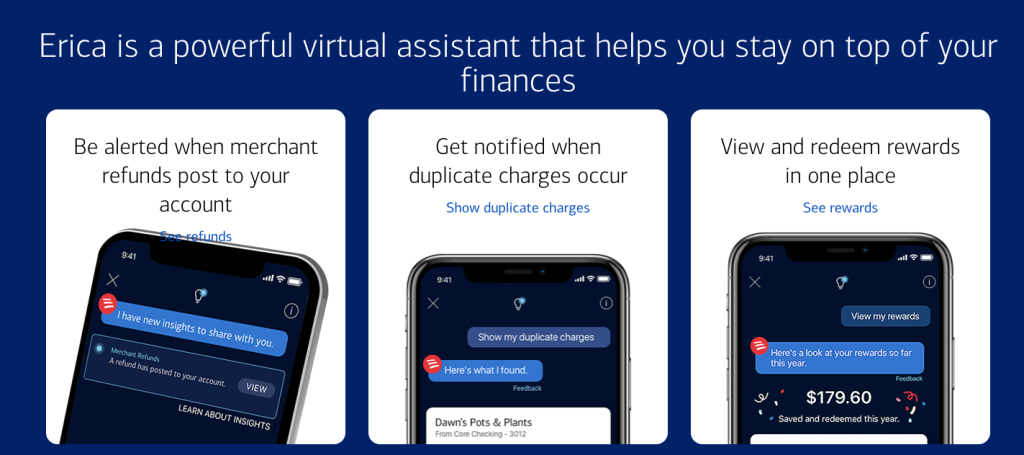

Erica

Erica is an AI-driven virtual assistant developed by Bank of America (BoA) to assist 25 million mobile users with various banking activities. Customers can easily access their past transitions and credit scores to achieve better money management via ‘Better Money Habits’.

Erica uses NLP to deliver advanced customer support by understanding complex questions and providing relevant responses. It can also learn from customers’ interactions and preferences to offer personalized banking advice.

Abe.AI

Abe.AI is a financial technology company that provides AI-powered virtual assistants and financial institutions. Like Erica, it uses NLP as well as ML to provide personalized banking advice to users and small businesses.

It can integrate with existing banking systems to chat with customers, answer FAQs, help people open accounts, and connect them to the call center directly for immediate customer support.

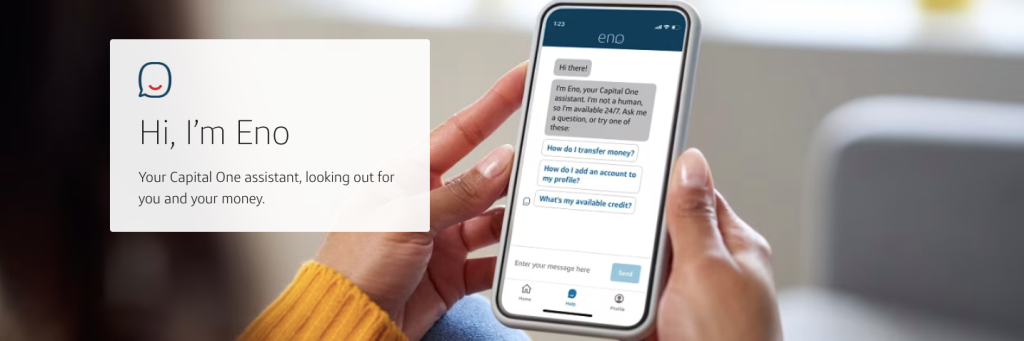

Eno

Capital One, a bank holding company, launched a text-based financial advisor called Eno in 2017. It is designed to help its clients manage their accounts more easily and is capable of learning consumer behavior to adapt to their needs.

When customers sign up for Eno, they can link their Capital One credit card account to the chat service. Once linked, they can interact with Eno via text message to access any information about their account that they wish.

Summary

There are many benefits that come with using AI VFAs for investment growth. Handling our finances and putting them in all the right places to make it go further has never been so easy. It has also never been so accessible, as nearly everything is now compatible with our smartphones and our favorite banks.

Our money is in a safe place, and what we decide to do with it to grow investments has become something we no longer have to worry about because AI knows exactly where to invest it and where to take it away. This ensures that our best interests are paramount, and we can feel confident knowing that we’ll reach our financial goals.

Did you know that there were AI assistants optimized for growing investment? To learn more about what AI can do, head over to Top Apps.

Christina Muir

Christina's expertise in the tech industry allows her to provide insightful and informative content to her readers, covering a range of topics from productivity and lifestyle apps to gaming and entertainment software.

Recent Articles

Microsoft servers are down. Your business grinds to a halt. Panic sets in. Stop. Breathe. You’ve got this. This guide gives you 7...

Read More

As a business leader, you’re always searching for ways to stay ahead of the competition. What about AI in marketing and sales? In...

Read More

Struggling to keep up with the competition in 2024? You’re not alone. Small and medium enterprises (SMEs) are facing a rapidly evolving business...

Read More