Published on: April 12, 2024

AI Budgeting Tools: 2024’s Comprehensive Guide

Author: Inge von Aulock

AI budgeting tools are no longer a luxury in 2024; they’re a necessity.

In a world where financial management is as complex as it is crucial, these tools are your secret weapon. They’re not just about number crunching. They’re about accuracy, efficiency, and personalized recommendations that can transform your financial health.

This guide is your roadmap to understanding, choosing, and maximizing AI budgeting tools.

From the top apps of 2024 to the predicted trends, we’ve got you covered.

Let’s make your finances smarter, not harder.

AI Budgeting Tools in 2024

- AI budgeting tools are revolutionizing financial management with their accuracy, efficiency, and personalized recommendations.

- The top AI budgeting apps of 2024 are your personal finance assistants, creating budgets based on your income, expenses, and financial goals.

Understanding AI Budgeting Tools: What They Are and How They Work

AI budgeting tools are digital platforms that leverage artificial intelligence to manage, track, and optimize your financial budget. They are designed to automate the tedious process of budgeting, making it more efficient and accurate.

These tools work by analyzing your income, expenses, and financial goals to create a personalized budget. They can track your spending habits, identify areas where you can save, and provide real-time updates on your financial status.

The benefits of using AI for budgeting are numerous. For one, they offer unparalleled accuracy. A study by Accenture found that AI can reduce budgeting errors by up to 37%.

Moreover, AI budgeting tools are efficient. They can process large amounts of data in a fraction of the time it would take a human. This allows you to spend less time budgeting and more time focusing on your business.

Finally, AI budgeting tools provide personalized recommendations. They analyze your financial behavior and provide tailored advice to help you reach your financial goals. According to a survey by PwC, 72% of business executives believe that AI will be the business advantage of the future.

Top AI Budgeting Apps in 2024: Your Personal Finance Assistant

In 2024, there are several top-tier AI budgeting apps that act as your personal finance assistant. These apps not only track your spending and income but also create a budget for you based on your financial goals.

One such app is Mint, a popular budgeting tool that uses AI to categorize transactions and provide insights into spending habits. Despite rumors of its shutdown, Mint continues to be a reliable tool for many users in 2024.

Another noteworthy app is PocketGuard. This app uses AI to analyze your financial situation and create a personalized budget. It also provides real-time updates on your spending and savings, helping you stay on track with your financial goals.

Lastly, there’s YNAB (You Need A Budget), an app that uses AI to give every dollar a job, ensuring that you’re allocating your income effectively. According to user reviews, YNAB has helped users save an average of $600 in their first two months.

Here is a list of additional AI budgeting tools that might be helpful for both personal and business financial planning:

- Emma: Offers comprehensive budgeting features like automatic spending tracking, subscription tracking, and personalized financial insights. It’s known for being user-friendly and affordable, with both free and paid plans available. More details are on their official site.

- Snoop: This app is great for tracking spending, creating budgets, and offering bill reminders and credit score monitoring. It also provides exclusive discounts and is available in free and paid versions. You can learn more about Snoop here.

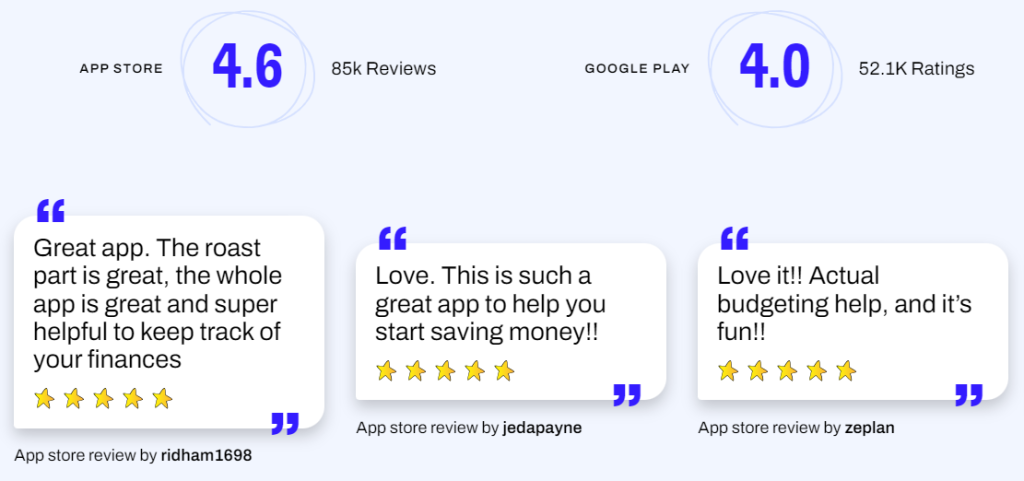

- Cleo: Known for its engaging user interaction with features like “Roast” and “Hype” modes, Cleo provides overdraft alerts and comprehensive financial management tools. Cleo has a strong emphasis on security and is designed to be both informative and entertaining. Further information can be found on their site.

- Mogami: This app focuses on enhanced privacy and secure data handling. It employs AI to assist with budget planning and is notable for its user privacy and data security measures. Mogami’s details are available here.

- EveryDollar: Known for its simplicity and focus on zero-based budgeting, EveryDollar allows users to track expenses and create customizable budgets. It’s particularly user-friendly but lacks a free version. More about EveryDollar can be found on TechEmergent.

- Goodbudget: Utilizes the traditional envelope budgeting method in a digital format, allowing for effective budget management across various platforms. It’s known for its shared budgeting features and real-time expense tracking. More information is available on TechEmergent.

These tools use AI to enhance their functionality, helping users manage their finances more effectively by providing insights, tracking expenses, and even assisting with investment decisions in some cases. Each tool offers unique features that cater to different budgeting needs, so choosing the right one will depend on your specific financial goals and requirements.

These are some of the best AI-powered personal finance tools that you need to check out. These AI budgeting apps are revolutionizing the way we manage our finances, making budgeting more accessible and efficient than ever before.

Maximizing the Benefits of AI Budgeting Tools

As we continue to navigate the ever-evolving landscape of AI budgeting tools in 2024, it’s crucial to understand how to maximize their benefits. This involves choosing the right tool and learning how to get the most out of it.

Choosing the Right AI Budgeting Tool: Factors to Consider

When it comes to selecting an AI budgeting tool, several factors come into play. The tool’s user-friendliness, features, security, and customer support are all critical considerations.

For instance, a tool with a user-friendly interface can significantly reduce the time spent on budgeting tasks. Features such as real-time data analysis, predictive analytics, and automated reporting can streamline your budgeting process. Security is paramount, especially when dealing with sensitive financial data. Lastly, reliable customer support can make all the difference when you encounter issues or need assistance.

To determine which software is best for creating a budget, consider your individual needs and preferences. If you’re a small business owner, you might prioritize affordability and ease of use. On the other hand, a large corporation might require advanced features and robust security measures.

Getting the Most Out of Your AI Budgeting Tool: Tips and Tricks

Once you’ve chosen your AI budgeting tool, it’s time to maximize its benefits. Setting realistic financial goals, regularly updating income and expenses, and fully utilizing the tool’s features are all effective strategies.

For example, setting realistic financial goals can help you stay on track and avoid overspending. Regularly updating your income and expenses ensures that your budget reflects your current financial situation. Lastly, taking full advantage of the tool’s features can help you gain a deeper understanding of your finances and make informed decisions.

Related Reading: 5 Best AI Investing Bots for Effective Stock Trading

The Evolution of AI Budgeting Tools: A Look Back at 2023

The Rise of Cleo Finance: Revolutionizing Personal Finance Management

In 2023, Cleo Finance emerged as a game-changer in the realm of personal finance management. This AI-powered tool, with its unique features, has revolutionized the way individuals manage their finances. Cleo Finance is an AI budgeting tool that assists users in managing their money, tracking their spending, and saving for their future.

One of the standout features of Cleo Finance is the Cleo Cash Advance. This feature allows users to borrow money in times of need, providing a safety net for unexpected expenses. The amount Cleo lets you borrow depends on your financial health and spending habits, ensuring you’re never in over your head.

Cleo Finance has also earned a reputation for being a safe app to use. It employs bank-level encryption and security measures to protect users’ data, ensuring peace of mind for its users.

User testimonials and reviews from 2023 highlight the positive impact Cleo Finance has had on personal finance management. Users have praised its intuitive interface, accurate budgeting, and the convenience of having a personal finance assistant at their fingertips.

The Future of AI Budgeting Tools: Predictions for 2024 and Beyond

TL;DR:

- AI integration in Rocket Money is revolutionizing personal finance.

- AI budgeting tools are set to become more personalized, secure, and integrated with other platforms in 2024.

- The long-term future of AI budgeting tools promises advancements and challenges that users need to adapt to.

The Integration of AI in Rocket Money: A Game Changer in Personal Finance

Rocket Money, a leading player in the personal finance landscape, has been making waves with its integration of AI. This move has significantly enhanced the user experience, offering personalized budgeting advice, automated bill payments, and predictive spending analysis.

Experts predict that this integration will influence other financial platforms to follow suit. The use of AI in Rocket Money is not just a trend, but a game-changer that is setting a new standard for personal finance management.

To answer a common query, yes, Rocket Money does use AI. It leverages AI to analyze user spending habits, predict future expenses, and offer personalized budgeting advice. This data-driven approach has made Rocket Money a reliable tool for many users.

Related Reading: The Pros and Cons of AI-Powered Personal Finance: What You Need to Know | INVESTED MOM

Predicted Trends in AI Budgeting Tools for 2024

As we move further into 2024, AI budgeting tools are expected to become more personalized, secure, and integrated with other financial platforms.

Personalization will be taken to new heights, with AI tools offering budgeting advice tailored to individual financial goals and spending habits. Improved security measures will also be a key focus, with AI algorithms being used to detect and prevent fraudulent transactions.

Integration with other financial platforms is another trend to watch out for. AI budgeting tools are expected to seamlessly connect with banking apps, investment platforms, and even cryptocurrency wallets, providing users with a comprehensive view of their financial status.

To leverage these trends, users should stay updated with the latest features of their AI budgeting tools and make full use of the personalization and security features offered.

The Long-Term Future of AI Budgeting Tools: What to Expect

Looking beyond 2024, the future of AI budgeting tools is both exciting and challenging.

On the one hand, advancements in AI technology could lead to even more personalized and predictive budgeting tools. We could see AI tools that not only analyze past spending habits but also predict future expenses based on economic trends, changes in personal circumstances, and even changes in lifestyle habits.

On the other hand, these advancements could also bring challenges. As AI budgeting tools become more complex, there could be issues related to data privacy and security. Users will need to stay informed about these potential risks and take necessary precautions.

To adapt to these changes, users should keep learning about AI technology and its implications for personal finance. They should also be open to trying out new features and tools, while also being mindful of their data privacy and security.

Your AI Budgeting Journey: The Road Ahead

AI budgeting tools are transforming personal finance management with their accuracy, efficiency, and personalized recommendations. Top apps like Cleo Finance and Rocket Money are leading the charge, offering user-friendly features and robust security.

The future promises even more advancements, with trends pointing towards increased personalization and integration with other financial platforms. However, the key to maximizing these benefits lies in choosing the right tool and using it effectively.

Now, it’s your turn to take the reins. Explore the AI budgeting tools available, consider your personal needs and preferences, and start managing your finances with the power of AI. Remember, the tool is only as good as the user. So, set realistic financial goals, update your income and expenses regularly, and utilize all the features at your disposal.

How will you leverage AI to take control of your financial future?

Remember, the future of personal finance is not just about technology, but about the people who use it. So, go ahead, embrace the AI revolution and redefine your financial journey.

Inge von Aulock

I'm the Founder & CEO of Top Apps, the #1 App directory available online. In my spare time, I write about Technology, Artificial Intelligence, and review apps and tools I've tried, right here on the Top Apps blog.

Recent Articles

Microsoft servers are down. Your business grinds to a halt. Panic sets in. Stop. Breathe. You’ve got this. This guide gives you 7...

Read More

As a business leader, you’re always searching for ways to stay ahead of the competition. What about AI in marketing and sales? In...

Read More

Struggling to keep up with the competition in 2024? You’re not alone. Small and medium enterprises (SMEs) are facing a rapidly evolving business...

Read More