Published on: May 15, 2023 Updated on: February 14, 2024

The Many Benefits of AI Investment Management

Author: Claudia Bird

AI technology is revolutionizing almost every sector in the modern world, from marketing to healthcare. However, it is the financial service sector that seems to have embraced AI systems with open arms. According to one study, 97% of financial institutions have incorporated artificial intelligence into their business model.

An area that has been truly revolutionized by artificial intelligence is the asset management and investment management industry. Using a combination of AI techniques, including deep learning, data science, and machine learning, has enabled firms to streamline the investment process.

Come with us as we examine the many different benefits of using AI models for both personal investors and financial investment firms.

Top 7 use cases of using AI in investment management

There are countless beneficial use cases for using artificial intelligence in investment strategies, but we have summarized the seven most prolific ones below for asset managers.

1. Analyzing alternative data

Data is the most valuable currency in investment, allowing wealth managers to identify trends, patterns, and potential risks to improve portfolio optimization. In fact, an average of 67% of businesses in the financial market have reported either improved decision-making, financial performance, risk management, or operational efficiency from utilizing data analytics.

The most common sources of data come from within the firm itself, e.g., fundamentals, company filings, and earning calls.

However, a newly exploited area of financial data analytics focuses on examining alternative big data points to find undiscovered patterns and trends. These alternative unstructured data sets are sourced from outside the business. They can include:

- Foot traffic

- Social media posts from LinkedIn, Facebook, Twitter, and Instagram

- Website usage

- Shipping trackers

- Online search history

- Product reviews

- Satellite imagery

- Jet tracing

The rise of artificial intelligence has allowed companies to locate valuable information from across the web.

Often referred to as web scraping, this process uses bots, known as crawlers, to analyze the source code of websites. Using natural language processing (NLP) technology, these bots tag the data before an extractor collects the relevant information.

There are currently over four hundred alternative data aggregators providing this priceless information to half of the investment industry. The current top five providers include:

The following statistics highlight the benefits of this alternative data analysis for investors:

- 72% of investors report an improvement in their signal.

- One-fifth of firms state that alternative data was to thank for 20% of their alpha.

- 42% of asset management firms state that their alpha edge from alternative data lasted for at least four years.

- 69% of market leaders stated that they utilize alternative data to improve investment decisions and generate alpha.

The use cases of this alternative market data are vast and varied but include:

- Predictive modeling: This data is used to estimate how stock prices or a company’s financial standing will fluctuate.

- Demand forecasting: It also enables investors to predict the level of consumer demand for services, products, and brands.

- Investment research: Alternative data provides access to countless historical data streams that can aid in making the best investment decisions.

- Due diligence: Once a viable investment is lined up, it is important to use data sets to do in-depth research about the potential risks and benefits.

- Portfolio management: Once an initial investment is made, managers must use data analytics to monitor the account and decide on the future prospects of the transaction.

- Competitive edge: Traditional forms of data, such as press releases and financial reports, are sporadically released. In contrast, alternative data sources are continuously updated with the most current information.

- Relationships: Alternative data allows users to observe positive and negative relationships between different brands in specific geographic locations.

- Online activity: Monitoring web traffic can provide insights into how the general public intends to spend their money.

To highlight the importance of these alternative data sets to investment firms, here is a collection of real-world examples of it in use:

- CargoMetrics uses satellite imagery to track seaborne trade in real-time. In 2015, the business identified a slowdown in shipping and used this data to short-sell oil investments.

- Using natural language processing to analyze initial news reports about Hurricane Irene, a company was able to understand the risk to investments.

- A team from the New York University identified that health inspection results of neighboring restaurants and crime statistics influenced house pricing.

2. Fraud prevention

In 2022, investment fraud cases hit record numbers, with over 35,000 victims reporting an average of $108,500 loss. This is a crisis that needs a viable solution and fast.

Traditionally, the detection of investment fraud in investment management firms involved the following procedures:

- An effective whistleblower program

- Human data analytics

- Dedicated anti-fraud employee training

- Third-party valuation specialists

- Multiple valuation methods

- Knowledge of valuation theory

- Broadened review panel for transactions

- Comparing potential investments to their competitors

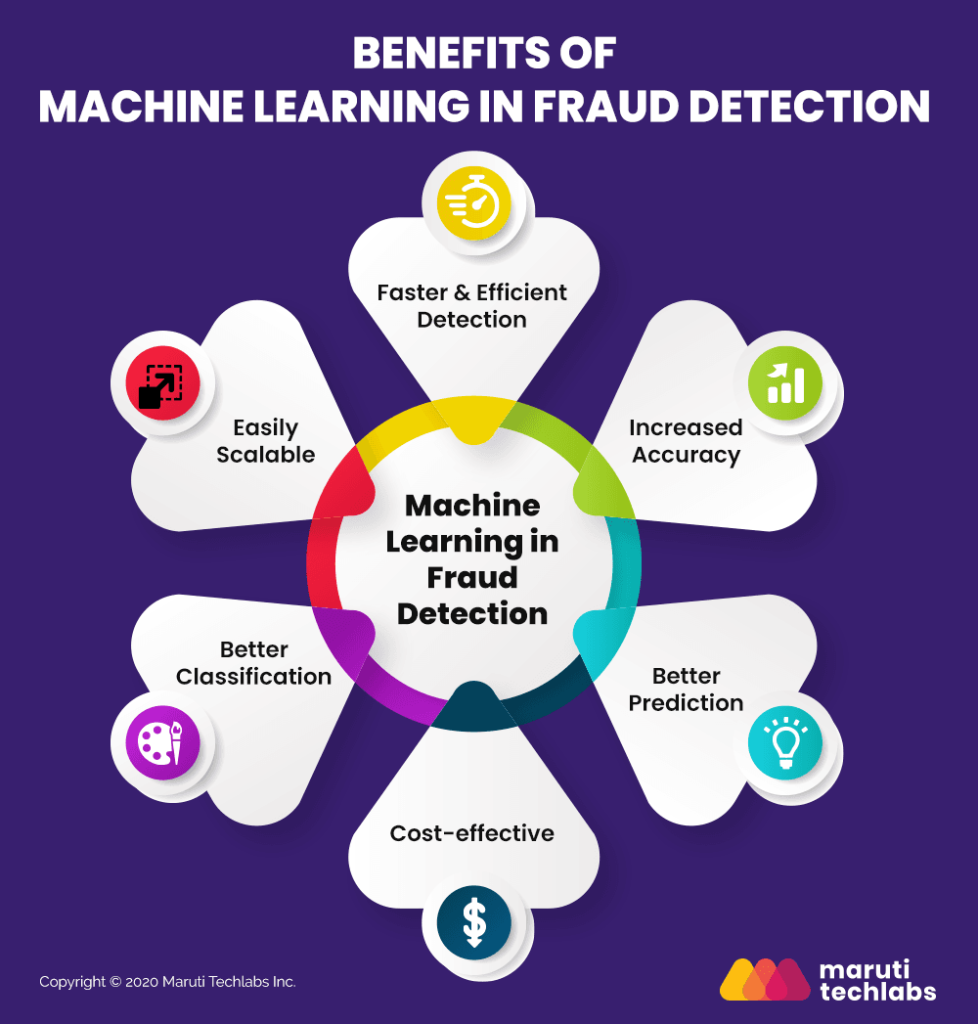

These approaches to detecting investment fraud are evidently flawed, especially as fraudulent schemes become more advanced and harder to detect. A combination of machine learning and analytics has allowed data scientists to identify fraudulent activity efficiently and accurately.

Machine learning algorithms are being used in two distinct means:

- Supervised: This AI system is provided with training data that enables it to classify transactions as either fraudulent or non-fraudulent.

- Unsupervised: This type of machine learning can be used to identify unusual patterns, trends, and behavior that could be an indicator of fraud.

The use of AI in identifying fraudulent activity has numerous benefits, which include:

- Faster detection: Machine learning can locate fraudulent activity in seconds, which could have taken months for an employee to find.

- Review time: As these systems are loaded with training data, they can make automatic assessments on validating transactions.

- Large data sets: The ability of artificial intelligence to comb through complex big data is astronomically more effective than their human counterparts.

- Cost-effective: A machine learning algorithm is considerably less costly than hiring an entire team of specialists.

- Human error: AI is less prone to mistakes; a study found that machine learning systems can achieve 96% accuracy in identifying fraudulent behavior.

- Hidden patterns: Artificial intelligence is able to detect patterns and trends that humans are unable to see.

- Real-time: These AI tools can identify fraudulent activity before it even occurs rather than after the crime has been committed.

3. Lead generation and retention

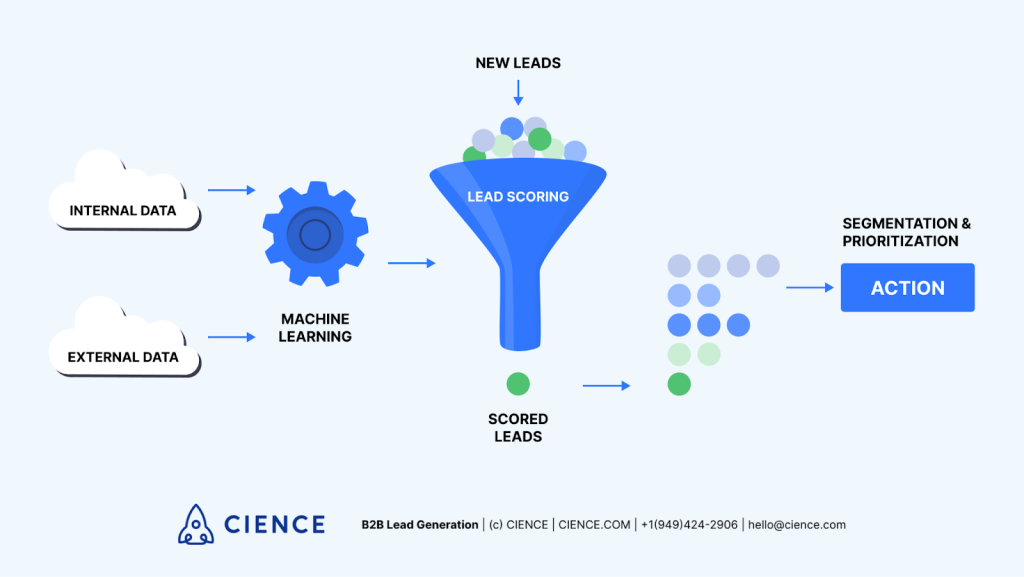

Financial advisors seek out prospective new clients by manually trawling through countless data sources and outreaching to viable candidates. This is a time-consuming and often unattractive method of initiating conversations about investment with affluent prospects.

Unfortunately, 78% of all client prospecting fails; however, with the technological advancements provided by artificial intelligence, this could soon be an issue of the past. AI applications have revolutionized lead generation in the following ways:

- Increase leads: AI has demonstrated that it can increase leads by more than 50% than standard methods of outreach.

- Automated lead scoring: Artificial intelligence can analyze data sets to determine the likelihood of a successful transaction.

- Segmentation: These systems are able to generate customer profiles that enable advisors to predict client investment needs and desires.

- Targeted campaigns: Algorithms can discover client information that enables advisors to create personalized outreach strategies.

- Increased effectiveness: AI automates many repetitive tasks associated with lead generation, which cuts operational costs and saves time.

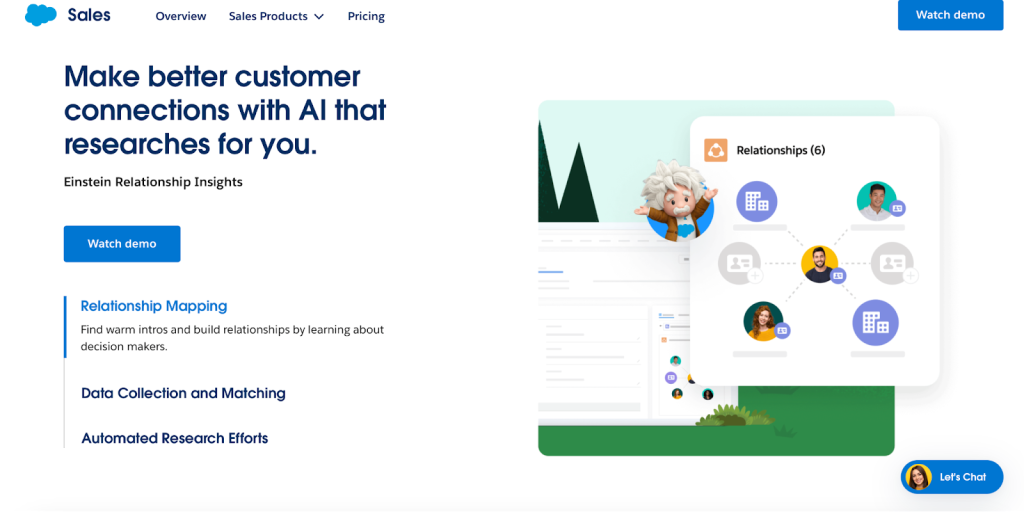

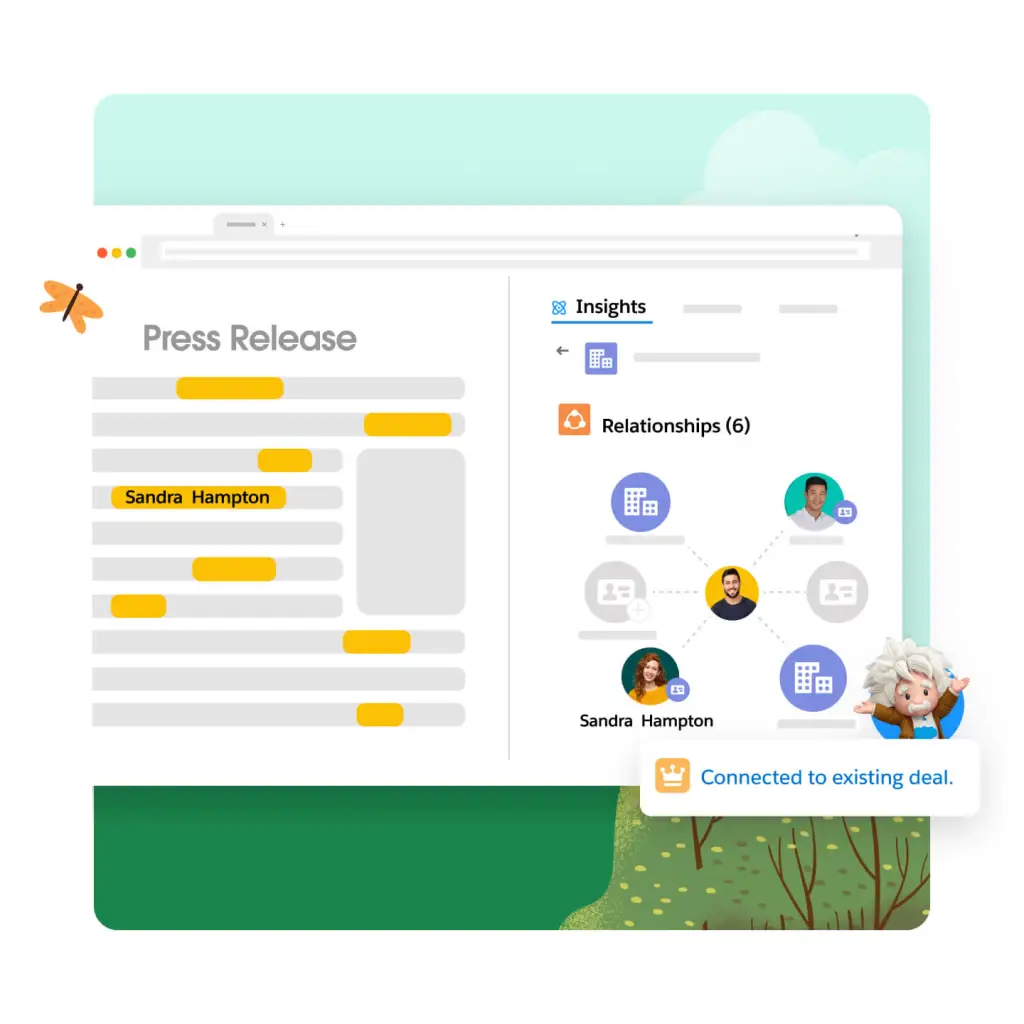

An example of an artificial intelligence lead generation tool is Salesforce’s Einstein Relationship Insights.

This tool searches big data sources and identifies relevant leads. It then provides information about these clients sourced from numerous internal and external sources, including:

- News sites

- Social media posts

- Press releases

- Collaboration apps

- Emails

This data-driven approach allows advisors to create high-quality outreach campaigns that are specifically tailored toward the prospective client.

Once these clients are boarded, it is essential to retain their business. Due to the volatility of the current economy and capital markets, one-third of clients have moved to another management firm, while 33% are considering transitioning within the next three years.

If an algorithm is trained with data about former clients who have closed or moved accounts, then it can identify worrisome patterns and trends in behavior. This allows hedge fund managers to intervene by engaging with high-risk clientele and attempting to resolve any underlying issues.

4. Workflow optimization

9 out of 10 workers are faced with monotonous tasks that waste an estimated 41.4% of their work week. This unfortunate statistic means mammoth financial losses for investment firms as it minimizes advisors’ time securing clients and brokering deals.

It is estimated that the average adult spends an unbelievable 21 hours and 36 minutes a week on administrative work. Processing legal and unstructured documentation for client onboarding is an enormous undertaking that consumes an incredible amount of a financial advisor’s time.

These documents include:

- Broker statements

- Asset valuations

- Gift certificates

- Share certificates

- Pay stubs

- Mortgage statement

- Credit card statement

- Student loan statement

- Child support documents

- Disability insurance

- Government ID

- Tax documents

- Passports

- Proof of address

Paperwork automation, fueled by artificial intelligence, can undertake the repetitive and non-profitable task of extracting this data without human intervention in the following simple steps:

- Input: This stage is where the documents are uploaded into the application. This can be done via scanning, file transfer, download, or email attachment.

- Classification: The AI algorithm will then use a combination of machine learning and natural language processing to categorize the document.

- Extraction: During this phase, the unstructured data is translated into structured data that is machine-readable.

This automation process can provide multiple benefits for investment management firms, including:

- Financial regulations: There are countless rules and regulations that must be abided by in this sector for a company to avoid lawsuits and fines. For instance, client confidentiality is crucial but difficult to obtain with paper documentation that can easily fall into unauthorized hands. Electronic storage allows users to provide an extra level of security surrounding private documentation.

- Cost: The average annual cost of printing equates to a shocking $725 per employee. The automation of this process allows forms to be created and stored electronically, removing the cost of the unnecessary printing of documents.

- Efficiency: The onboarding of new clientele is a time-consuming process that involves fact-checking, fraud prevention, negotiating terms, and signing documentation. With the utilization of automation software, it is estimated that a new account can be registered in 30 minutes by digitizing forms and improving workflows.

5. Risk management

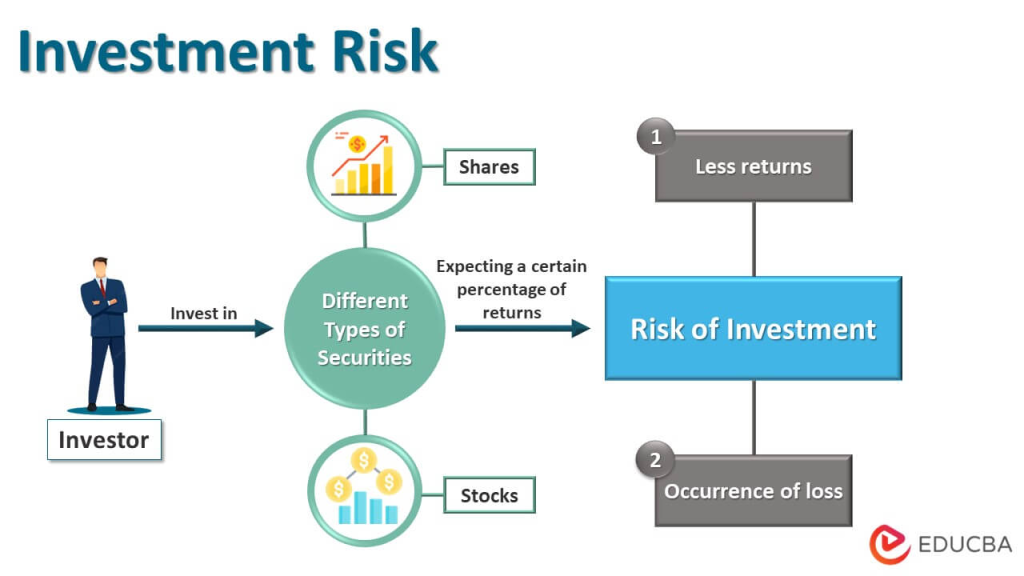

In terms of investment, risk relates to the possibility of financial loss. It is estimated that about 90% of all traders lose money on investments.

Therefore, it has become incredibly important to analyze the risk-return ratio to inform decision-making about potential investments. The risk-return ratio refers to the amount of risk associated with an investment and the potential for return.

Financial risk can be divided into two distinct categories:

- Systematic: These are factors that affect the entire economic market.

- Unsystematic: This type focuses on a specific industry or company.

Common examples of these types of risk can be seen in the table below.

| Type of risk | Systematic or unsystematic | Description |

| Business | Unsystematic | This relates to whether a company is able to generate enough revenue to cover costs. |

| Credit | Unsystematic | This focuses on the ability of a business to pay its debt obligations. |

| Country | Systematic | Analyze if the company’s home country is able to honor financial obligations. |

| Foreign exchange | Systematic | The effect of foreign exchange rates on the price of an asset. |

| Interest rate | Systematic | The ability of interest rates to fluctuate the investment value. |

| Political risk | Systematic | Returns could be affected by political upheaval or development in a country. |

| Counterparty | Unsystematic | The potential for a party involved in a transaction to default on a contractual obligation. |

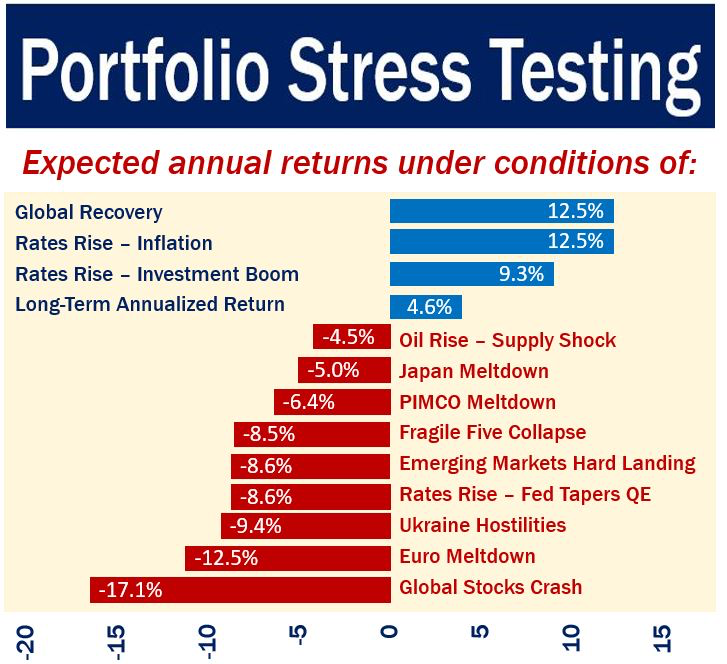

The ability of artificial intelligence to examine big data and utilize deep learning can drastically streamline the risk management process. The following benefits can be achieved by using AI:

- Predict the likelihood of members of a transaction defaulting.

- Monitor the health of loan borrowers.

- Perform market stress tests to see how investments fare in extreme circumstances.

- Provide continuous monitoring of the financial markets to predict risk.

- Examine countless sources to identify political unrest, pandemics, recessions, and other international factors.

- Artificial intelligence is able to detect anomalies and flaws in standard risk models.

- AI is able to predict market volatility and crashes.

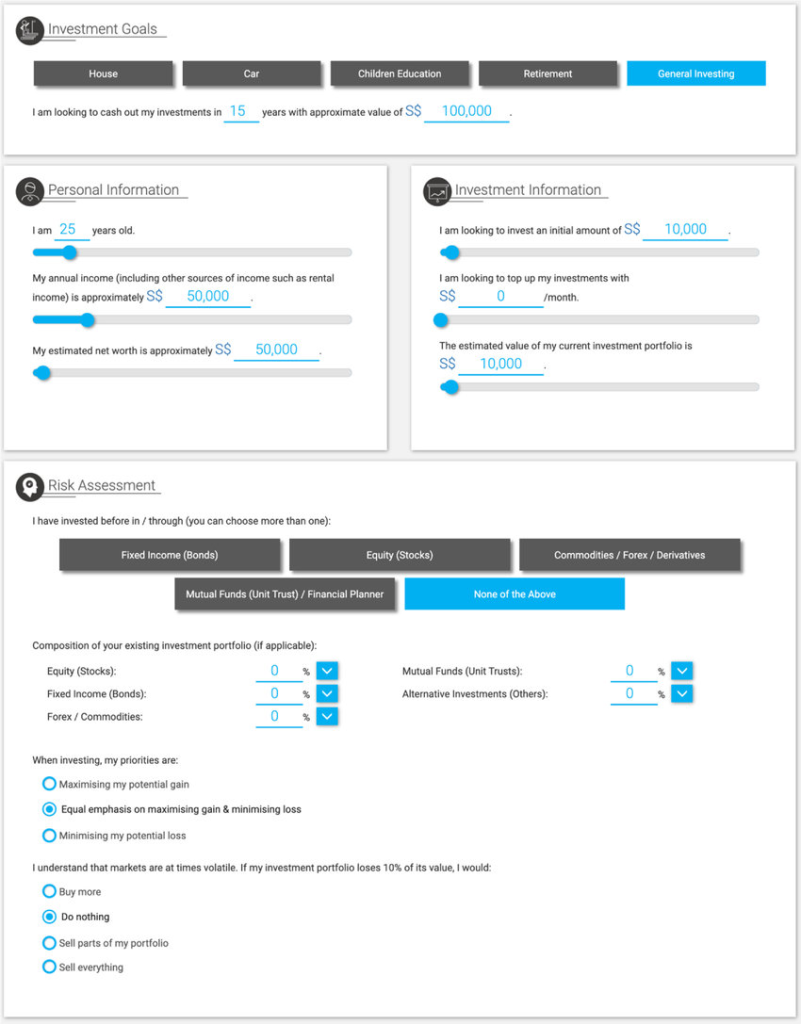

6. Robo advisors

As the name suggests, robo advisors are artificial intelligence advisors that are able to provide personalized financial and investment services with limited human intervention. This industry is rapidly growing, with some estimates calculating that there will be over 234.30 million users with assets worth $4.66 trillion using robo advisors by 2027.

This sophisticated technology is able to build an in-depth character profile that takes into consideration behavior, ambitions, finances, risks, and preferences. They’ll act as your virtual portfolio manager.

To acquire this information, the program will send a questionnaire to gauge demographic and behavioral data. Common extracted data includes:

- Age

- Gender

- Income

- Net worth

- Goals

- Initial investment

- Expectations

- Former investments

Artificial intelligence is able to examine data about financial transactions to further understand the behavior of the potential investor. This enables the algorithm to find information that may be unknown or overlooked by the client, including:

- Higher spending

- Undiscovered liabilities

- Decision-making behavior

- True net worth

- Spending patterns

This rich data enables the robo advisor to provide some incredible benefits to their clients, including:

- Auto investing: The algorithm is able to select the perfect investments for a client based on their answers and investment style.

- Balancing: Artificial intelligence can continuously tweak and adjust investments to match your goals.

- Advice: A robo advisor is able to provide personalized advice that reflects your behaviors and current situation.

- Management: This technology can easily navigate between your personal preferences and external risks, acting like personal portfolio managers.

Are you unsure if robo-investment is the correct choice for you? Check out the below table that elaborates on some of the distinct advantages and disadvantages of this impressive tech.

| Advantages | Disadvantages |

| These tools make investing approachable for everyone, even those with limited funds. | Limited customization in investing planning. |

| There is no prior knowledge requirement for investors. | Lack of face-to-face meetings or financial expertise. |

| Lower costs in comparison to human financial advisors. | Unable to choose your own investments. |

| Lack of bias in making investment decisions. | Struggle with complex investments. |

| Less paperwork is required for onboarding. | Constant rebalancing can cause excessive fees. |

| Automatic rebalancing and tax loss harvesting. | Tax loss harvesting creates more paperwork. |

| Inability to make financial decisions on emotions. | |

| Saves investor’s time and energy. |

Now that we have discussed the pros and cons of robotic investing, take a look at our top 5 picks of robo advisor companies:

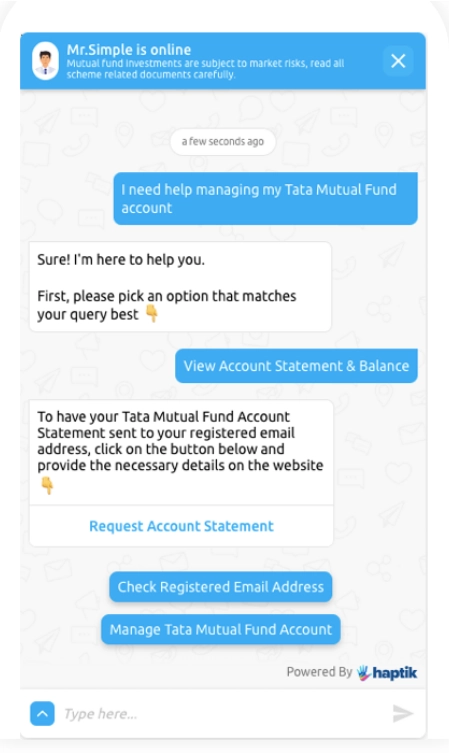

7. Chatbots

Throughout the entire investment process, clients will most likely have continuous questions about different aspects of their portfolios. Traditionally, live customer service agents are the ones to answer these types of queries; however, automated chatbots are revolutionizing this time-consuming task.

In 2022, chatbots, such as ChatGPT, saved businesses an estimated 2.5 billion hours, which translates to $8 billion. In the wealth management sector, chatbots can be beneficial to countless use cases through automation, including:

- Onboarding: Chatbots are able to collect onboarding documents and introduce the investment platform to new customers.

- Financial advice: Using natural language processing and machine learning, chatbots can understand a client’s needs and behavior to offer optimum advice.

- Education: Artificial intelligence is able to educate clients about financial practices.

- Notifications: Chatbots can send personalized notifications, including stock watchlist alerts, authentication messages, and transactional details.

- Queries: Clients are able to ask chatbots complicated questions and receive automatic answers.

There are countless benefits of using artificial intelligence-infused chatbots in wealth management, which include:

- 24/7: Chatbots do not become sick, tired, or need vacations; therefore, this autonomous tech can be available to answer client needs whenever needed.

- Multiple clients: Chatbots are able to talk to multiple clients at the same time, which drastically improves response time.

- Multilingual: This technology can understand queries and respond to them in a multitude of languages.

- Costs: The implementation of these bots can result in reduced labor and operating costs.

- Efficiency: Using this technology can allow human financial advisors to undertake more important tasks.

Top 15 AI investment fintechs

Below, we have listed the top fifteen artificial intelligence fintech companies that are revolutionizing the investment industry. Visit their websites now to see how they can improve your investment management strategies.

- TradeIdeas

- TrendSpider

- Ellevest

- Betterment

- Invstr

- Black Box Stocks

- Tickeron

- Kavout

- Zignaly

- Acorns

- Charles Schwab

- VectorVest

- Wealthbase

- Robinhood

- Wealthfront

Invest in AI success

The implementation of artificial intelligence into wealth management has made investment schemes accessible to countless new clients by simplifying the process and lowering costs.

This has ensured that this sector will continuously grow, with estimates currently predicting that this technology is expected to be worth $13.4 billion by 2027. Whether you are a financial firm or a personal investor, we recommend investing in this new industry trend now to give yourself a cutting edge against competitors before it becomes common practice.

For more information on how artificial intelligence can give you an upper hand against your competitors, check out our extensive library of AI apps.

Claudia Bird

With years of experience writing for various online publications, Claudia has developed a reputation for producing high-quality content that is both informative and engaging. Her articles cover a wide range of topics, from app reviews and user guides to in-depth analyses of the latest trends in technology.

Recent Articles

Microsoft servers are down. Your business grinds to a halt. Panic sets in. Stop. Breathe. You’ve got this. This guide gives you 7...

Read More

As a business leader, you’re always searching for ways to stay ahead of the competition. What about AI in marketing and sales? In...

Read More

Struggling to keep up with the competition in 2025? You’re not alone. Small and medium enterprises (SMEs) are facing a rapidly evolving business...

Read More