WeFIRE

Your AI-Powered Personal Finance Copilot for Achieving Financial Independence, Retire Early (FIRE).

Best for:

- Aspiring FIRE enthusiasts

- Seasoned investors

- Financial planners

Use cases:

- Tracking financial progress

- Receiving personalized financial advice

- Connecting multiple financial accounts for comprehensive analysis

Users like:

- Personal Finance

- Investment Strategy

- Financial Planning

What is WeFIRE?

Quick Introduction

WeFIRE is an AI-empowered personal finance tool designed to help individuals achieve financial independence and early retirement. With its cutting-edge technology, WeFIRE acts as a fully interactive copilot that provides personalized services 24/7. Whether you’re just getting started on your financial journey or you’re a seasoned investor looking to optimize your strategy, WeFIRE offers insights, recommendations, and actionable advice tailored specifically to you. This tool is perfect for anyone who needs a comprehensive overview of their financial health, instant answers to their finance-related questions, and a structured plan to steadily progress towards their financial goals.

Pros and Cons

Pros:

- Personalized Insights: WeFIRE uses advanced AI algorithms to provide tailor-made advice based on your unique financial data.

- Holistic View: The tool integrates with multiple accounts via Plaid, offering a consolidated view of your finances.

- Educational Resources: WeFIRE curates a wealth of educational material to help users better understand financial concepts and strategies essential for the FIRE journey.

Cons:

- Learning Curve: The tool’s wide range of features might take some time for new users to fully grasp.

- Subscription Costs: While offering free trials and premium features, the subscription fees might be steep for users on a tight budget.

- Limited to FIRE Community: Specifically designed for those pursuing FIRE, the tool might not suit individuals with different financial goals.

TL;DR

- Personalized financial guidance

- Comprehensive account overview

- Proactive financial alerts and recommendations

Features and Functionality

- AskCopilot: Get personalized responses to any financial question based on your unique data.

- Comprehensive Account Overview: Sync all your financial accounts for in-depth analysis and visualizations.

- For You Feature: Timely alerts and updates on important financial activities.

- FIRE Plan: Input goals for progress tracking and tailored budgets to balance frugality and indulgence.

- Educational Resources: Access a curated library of articles and guides to deepen your financial knowledge.

Integration and Compatibility

WeFIRE integrates seamlessly with various financial institutions via Plaid to provide a cohesive overview of your cash flow. It supports major banks and financial institutions, allowing users to connect multiple accounts for a comprehensive financial analysis.

Benefits and Advantages

- Tailored Financial Advice: Get specific advice tailored to your financial situation and goals.

- Holistic Financial View: Consolidates data from multiple accounts for a clearer financial picture.

- Educational Resources: Extensive materials to help improve financial literacy and strategize better.

- Goal Tracking: Specific features to track your progression towards financial independence.

Pricing and Licensing

WeFIRE offers a flexible pricing model including a free trial for users to explore its premium features.

Do you use WeFIRE?

Subscription plans start at a reasonable rate, offering a plethora of advanced tools and resources. Detailed pricing tiers are available on the WeFIRE website, catering to different needs and budgets.

Support and Resources

WeFIRE provides robust support options including customer service via chat and email, detailed documentation and guides, as well as a community forum where users can share experiences and tips.

WeFIRE as an alternative to

Compared to Mint, WeFIRE offers more targeted insights and recommendations specifically for FIRE enthusiasts. While Mint provides an excellent overview of your financial health, WeFIRE adds an extra layer of personalization and educational resources tailored to achieving financial independence sooner.

Alternatives to WeFIRE

- Mint: Great for general personal finance management but lacks the specific focus on FIRE principles.

- YNAB (You Need a Budget): Excellent for budgeting but doesn’t provide the same level of AI-driven personalized advice.

- Personal Capital: Offers robust financial planning tools but is more geared towards wealth management than achieving FIRE specifically.

Conclusion

WeFIRE stands out as a comprehensive, AI-powered tool tailored for those looking to achieve financial independence and early retirement. With personalized insights, a holistic overview of finances, proactive alerts, and a wealth of educational resources, WeFIRE equips users with the knowledge and tools necessary for progressing effectively on their FIRE journey. Whether you’re a beginner or a seasoned investor, WeFIRE helps you act smarter, earn more, and ultimately, live a life of financial freedom and joy.

Similar Products

InnerWallet

Enhance your financial management with the built-in artificial intelligence of InnerWallet.

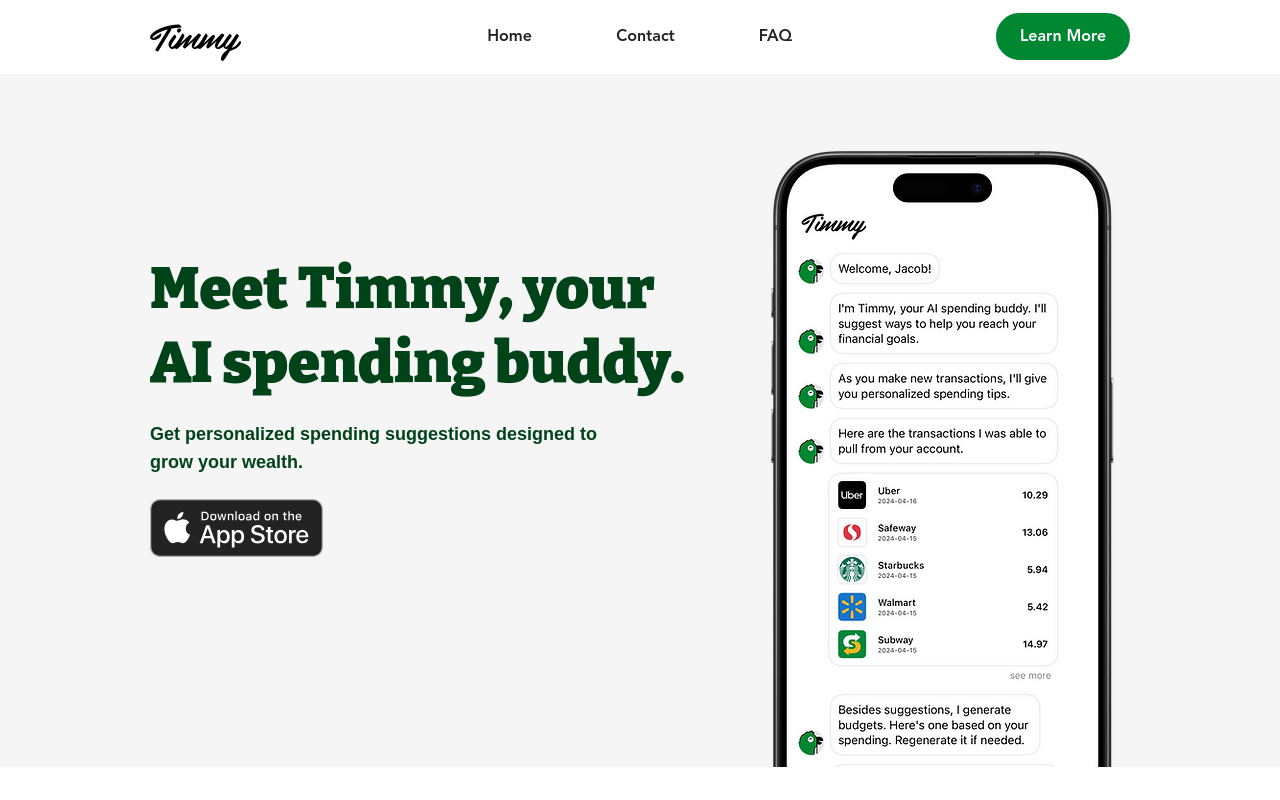

Timmy

Timmy is a personal AI spending buddy designed to provide personalized spending suggestions for wealth growth.