Timmy

Timmy is a personal AI spending buddy designed to provide personalized spending suggestions for wealth growth.

Best for:

- individuals looking to optimize spending

- students managing finances

- people planning for retirement

Use cases:

- personal finance optimization

- spending habit analysis

- budget tracking

Users like:

- sales

- hr

- management

What is Timmy?

###Quick Introduction

Timmy is an innovative AI-powered tool aimed at individuals who aspire to optimize their spending habits and grow their wealth. Using a dynamic combination of data analytics and machine learning, Timmy analyzes your spending patterns and provides personalized suggestions on how to better allocate your financial resources. As someone who’s always looking for ways to improve financial health, I found Timmy to be an essential addition to my toolkit, offering insights that have noticeably impacted my spending efficiency and savings growth.

Whether you’re a student, young professional, or someone planning for retirement, Timmy caters to a wide range of users with varying financial goals. The tool is user-friendly, making it easy for anyone to get started and receive actionable advice without needing to be a financial expert. Timmy’s primary objective is to identify patterns and recommend changes, ensuring you get the most out of every dollar you spend.

###Pros and Cons

Pros:

- Personalized Recommendations: Timmy tailors advice based on individual spending habits, making each suggestion relevant and actionable.

- User-Friendly Interface: The intuitive design ensures that even those with limited technical skills can easily navigate and use the tool.

- Comprehensive Analysis: Provides a thorough analysis of spending patterns, helping users identify areas of improvement.

Cons:

- Limited to Financial Advice: Timmy is focused solely on spending suggestions and doesn’t offer broader financial management features like investment tracking or debt reduction plans.

- Internet Dependency: Requires an internet connection for the best experience, potentially limiting its usability in offline scenarios.

- Learning Curve: Initial setup and understanding the diverse functionalities might take some time, especially for users unfamiliar with AI-based tools.

###TL;DR

- Personalized spending suggestions

- Easy-to-use interface

- Comprehensive spending analysis

###Features and Functionality

- Personalized Spending Suggestions: Based on an analysis of your financial data, Timmy offers tailored recommendations to help optimize your spending habits for better wealth growth.

- Spending Pattern Analysis: This feature breaks down your spending habits across various categories, providing you a clear picture of where your money goes, and highlighting areas for potential savings.

- Goal Tracking: Set financial goals within the app and track your progress over time with automated updates and reminders.

- Budget Creation: Timmy helps you create attainable budgets based on your income and spending habits, adjusting suggestions as your financial situation changes.

###Integration and Compatibility

Timmy seamlessly integrates with most banking platforms and financial tracking tools via secure API connections. Whether you’re using popular banking apps or third-party financial managers, Timmy fits right in, enhancing your financial monitoring and recommendations without needing manual inputs. The lack of broader software or programming language dependencies makes it a self-sufficient tool capable of functioning accurately and independently.

###Benefits and Advantages

- Improved Spending Efficiency: By receiving tailored spending advice, users can make more informed financial decisions, leading to efficient resource allocation.

- Time Saved: Automated analysis and recommendations reduce the time users spend poring over financial data to identify saving opportunities.

- Enhanced Financial Awareness: Regular updates and detailed analysis provide greater transparency over spending habits, promoting better financial health.

###Pricing and Licensing

Timmy offers a freemium model, where the basic version with essential features is free to use.

Do you use Timmy?

For users who want access to premium features like advanced analytics and exclusive spending tips, subscription plans are available at different tiers: Monthly ($9.99/month), Quarterly ($27.99/quarter), and Annual ($99.99/year). There’s also a 14-day free trial available which provides access to all premium features, allowing you to test before committing.

###Support and Resources

Support for Timmy users comes in multiple forms: 24/7 customer service via chat and email for immediate assistance, comprehensive documentation that includes step-by-step guides and FAQs, and an active community forum where users can exchange tips and share success stories.

###Timmy as an Alternative to:

Timmy stands as a compelling alternative to traditional budget apps like Mint by providing a higher degree of personalized spending advice. While Mint offers a broad view of financial status, Timmy drills down into spending habits to provide specific recommendations – enabling more precise improvements in financial behavior.

###Alternatives to Timmy

- Mint: Best for users seeking an all-in-one financial management tool with budgeting, bill tracking, and credit monitoring functions.

- YNAB (You Need A Budget): Ideal for individuals looking to adopt a zero-based budgeting approach with proactive money management techniques.

- PocketGuard: Useful for users who want a simplified approach to budgeting with an easy-to-read, real-time display of ‘what’s left’ after expenses.

###Conclusion

Timmy is an exceptional tool for individuals eager to gain control over their spending and improve their financial health. Offering unique personalized advice, it stands out by driving actionable changes in users’ spending habits. Its ease of use, superior integration capabilities, and comprehensive support make it highly suitable for a broad audience. Timmy is an indispensable asset in anyone’s financial toolkit, offering insights and recommendations that translate into tangible wealth growth.

Similar Products

InnerWallet

Enhance your financial management with the built-in artificial intelligence of InnerWallet.

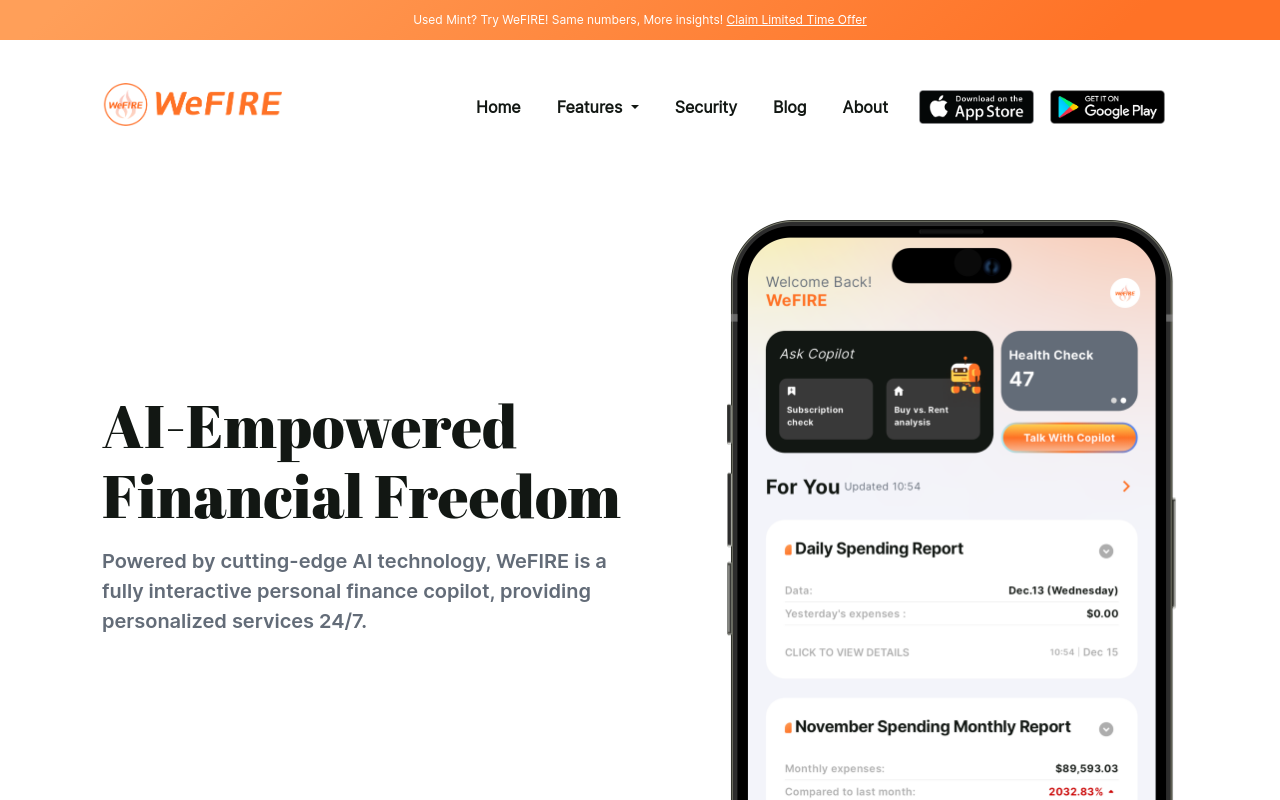

WeFIRE

Your AI-Powered Personal Finance Copilot for Achieving Financial Independence, Retire Early (FIRE).