InnerWallet

Enhance your financial management with the built-in artificial intelligence of InnerWallet.

Best for:

- Individuals wanting financial management

- Users setting financial goals

- People tracking expenses

Use cases:

- Budget planning

- Expense tracking

- Financial goal setting

Users like:

- Finance

- Personal Use

- Budget Planning

What is InnerWallet?

Quick Introduction

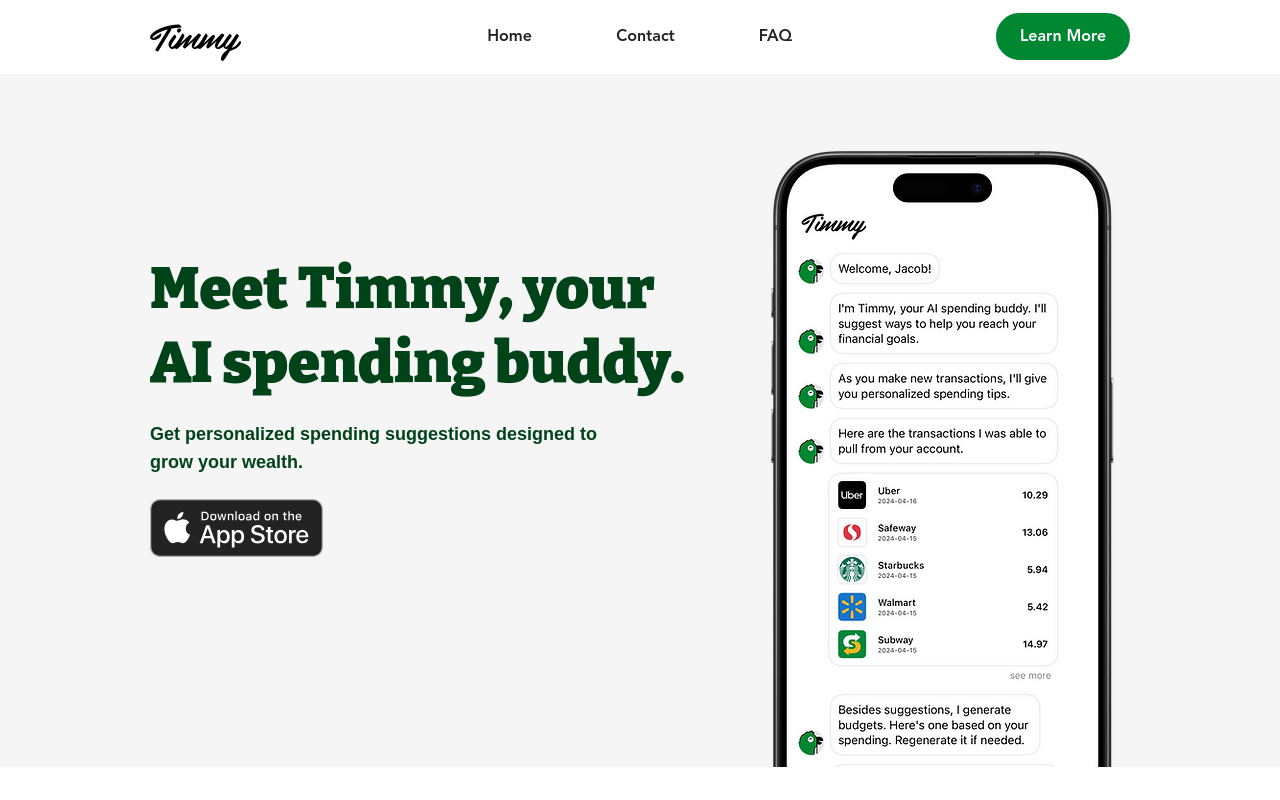

InnerWallet is an AI-driven personal finance management tool designed to revolutionize the way you handle your finances. It is tailored for individuals who wish to gain better control over their financial situation, set and achieve financial goals, and prepare for a financially stable future. By leveraging AI capabilities integrated with ChatGPT, InnerWallet allows users to communicate directly with their finances, obtain insightful budget suggestions, and monitor spending patterns efficiently. Whether you’re planning for a vacation, saving for a home, or just trying to keep your finances in order, InnerWallet is crafted to support every financial journey.

InnerWallet provides a seamless experience for tracking expenses, setting financial goals, and receiving real-time insights. By linking various financial accounts such as bank accounts and credit cards, users gain a holistic view of their financial health. The tool is ideal for anyone who finds traditional financial management cumbersome and is looking for a more intuitive, interactive approach. InnerWallet offers a range of features tailored to boost financial literacy and effectiveness, making it indispensable for both beginners and seasoned finance enthusiasts.

Pros and Cons

Pros:

- Intuitive AI-Integration: The ChatGPT functionality allows for dynamic and insightful financial conversations.

- Comprehensive Financial Overview: Easily link multiple accounts to get a complete picture of your finances.

- Goal Setting and Tracking: Set, monitor, and achieve financial goals with ease.

Cons:

- Cost: Not free, with pricing tiers that might be considered high by some users.

- Limited Asset Management for Investors: Doesn’t provide in-depth management for complex investment portfolios.

- Learning Curve: Initial setup and learning to interact with the AI might be a bit challenging for non-tech-savvy users.

TL:DR.

- Communicate with ChatGPT for finance insights.

- Track expenses and manage accounts seamlessly.

- Set and achieve financial goals with real-time AI insights.

Features and Functionality

- AI-Driven Financial Insights: Get real-time advice and suggestions by communicating with ChatGPT. Ask about budget recommendations, spending patterns, and more.

- Expense Tracking: Monitor your spending habits and categorize expenses to ensure optimized financial planning.

- Goal Setting and Monitoring: Define, track, and achieve your financial goals, whether they’re short-term or long-term.

- Account Linking: Link all your financial accounts—bank accounts, credit cards, etc.—to get a unified overview.

- Net Worth Calculation: Enter your assets and liabilities to see your net worth and financial standing.

Integration and Compatibility

InnerWallet seamlessly integrates with a variety of financial institutions allowing you to link your bank accounts, credit cards, and other financial services effortlessly. The tool supports most financial institutions, making it both versatile and robust. At present, there are no major integrations with programming languages or other external software, emphasizing InnerWallet’s standalone capabilities to deliver all-encompassing financial management.

Benefits and Advantages

- Real-Time Feedback: Instant insights and suggestions based on your current financial status.

- Comprehensive Management: All financial information in one place, facilitating easier management.

- Enhanced Decision-Making: Data-driven insights that allow for better financial decisions.

- Improves Financial Literacy: Learn and manage finances simultaneously with valuable AI outputs.

- Time-Efficiency: Saves time by automating routine financial tracking and planning tasks.

Pricing and Licensing

InnerWallet offers three main pricing plans tailored to various user needs:

- Monthly Plan: Priced at $9.99/month, includes a 7-day free trial, basic support, account management, expense tracking, and financial insights.

- Semi-Annual Plan: Costs $49.99/6 months ($8.33/month) with priority support via email, and early access to new features.

- Annual Plan: The best value at $89.99/year ($7.50/month), providing 24/7 premium support, exclusive content, and webinars, along with free access to future premium features. Limited to 100 spots at this price.

Support and Resources

InnerWallet offers extensive support options to its users, ensuring seamless user experiences.

Do you use InnerWallet?

These include basic support for monthly subscribers and priority support via email for semi-annual plans. Annual subscribers receive 24/7 premium support. Additionally, comprehensive documentation and potentially a community forum can provide users with helpful resources and troubleshooting advice.

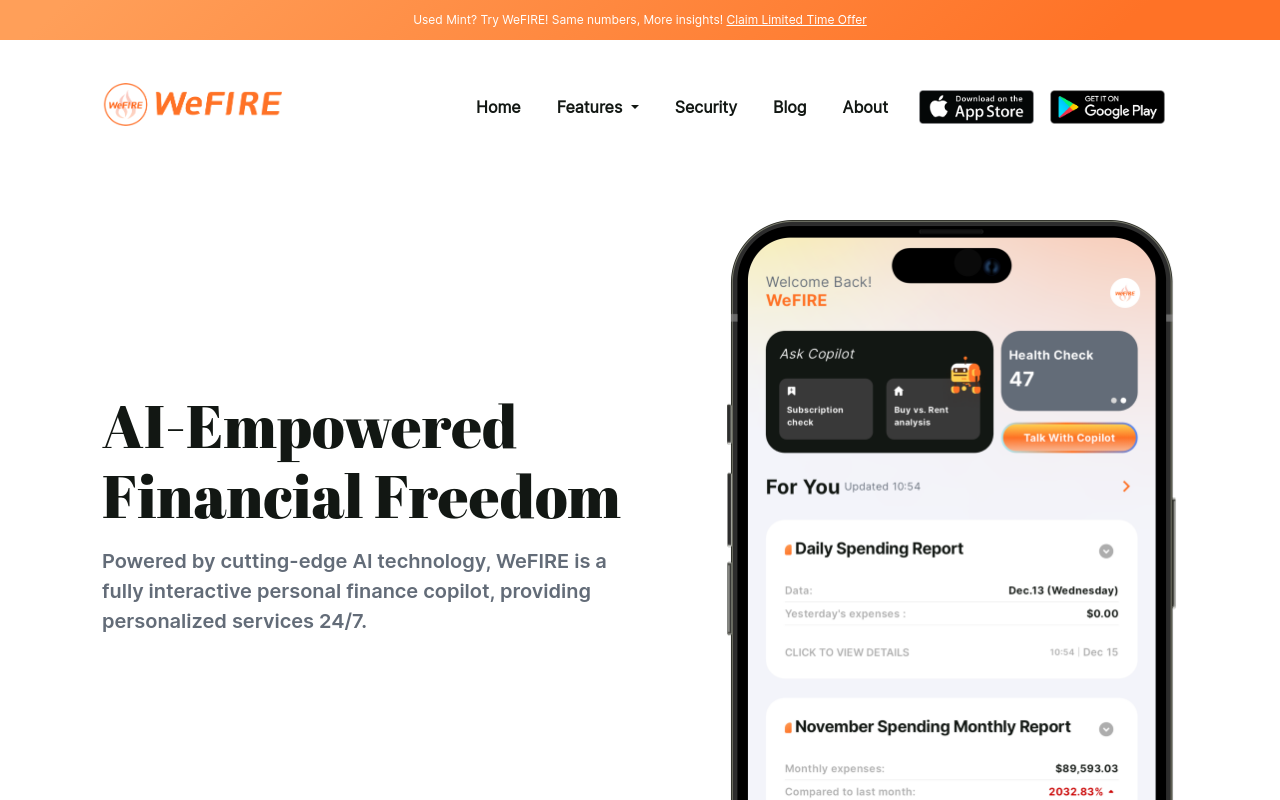

InnerWallet as an Alternative to:

InnerWallet can serve as an efficient alternative to traditional finance management tools like Mint. Unlike Mint, which offers standard budgeting and spending analysis, InnerWallet integrates AI to provide dynamic, personalized financial advice. While Mint is effective for basic tracking, InnerWallet’s AI-driven insights elevate financial management by providing real-time, interactive assistance.

Alternatives to InnerWallet:

- Personal Capital: Suitable for users focused on investment tracking along with standard expense management. Ideal for those needing in-depth portfolio analysis.

- YNAB (You Need A Budget): Best for proactive budgeting enthusiasts. YNAB’s philosophy and budgeting method can be particularly useful for users needing structured budgeting rules.

- Mint: For users seeking a free, all-encompassing tool for tracking expenses and budgeting, without AI-driven insights.

Conclusion

InnerWallet stands out as a cutting-edge personal finance management tool, leveraging AI-powered insights to provide comprehensive financial oversight. It simplifies the process of tracking expenses, setting goals, and making informed decisions. With tailored pricing plans and robust support, InnerWallet suits a wide variety of users, from the financially inexperienced to savvy experts. The integration with ChatGPT truly sets it apart, offering personalized financial advice and enhancing overall financial well-being.